Taking the stress out of saving for your tax

A simple guide for creatives, freelancers, and small business owners

If you work in the arts, the fun bit is creating. The boring bit is admin. And nothing feels worse than a big tax bill you weren’t ready for.

Here’s the good news: with a few simple habits, you can turn tax planning into just another task you’ve already planned for.

1. Companies vs Sole Traders – different setups, same idea

How you save depends on how you trade:

Limited Companies

Pay Corporation Tax on profits.

Directors also pay personal tax on dividends they take out.

Usually, you need two pots: one for the company, one for yourself.

Watch out: if you dip into company money to pay your personal tax, it isn’t a business expense. It normally counts as more income — meaning even more personal tax next year. That’s why a separate personal tax pot is essential.

Sole Traders

No Corporation Tax.

Just Income Tax and National Insurance, once a year.

Only need one pot: your personal tax pot.

Different setups, same idea: save as you go, not in a panic at the end.

2. VAT – if you’re registered

VAT you charge isn’t really yours — you’re just holding it for HMRC.

Best habit: move the VAT part of each payment into its own pot immediately.

Your actual bill is usually less, because you reclaim VAT on some costs. The leftover becomes a small buffer.

3. Corporation Tax – for companies

A simple rule of thumb: save 15–20% of your earnings (after VAT).

This usually works because most arts businesses have costs — travel, costumes, rehearsals, professional fees — that reduce taxable profit.

If your costs are low, you may need to save more. If they’re high, you may save less. The key is to look at your own numbers.

Reminder: Corporation Tax is due nine months after year-end. That money won’t be available for dividends until it’s paid.

4. Salary vs Dividends – they feel the same but aren’t

If you’re a company director, you might pay yourself through a mix of salary and dividends:

Salary

Counts as a company expense → lowers Corporation Tax.

PAYE & NIC are deducted before you receive it.

Tax is paid monthly by the company.

Dividends

Don’t reduce the company's profit.

No immediate tax savings.

You pay the tax yourself later via Self-Assessment (January and sometimes July).

In short:

Salary → lowers company tax bill, but cash goes out fast each month.

Dividends → easier on the company's cash in the short term, but leave you with a personal tax bill later.

5. Sole Traders – just one pot

Sole traders don’t deal with Corporation Tax or dividend tax.

Save 30–35% of profits to cover Income Tax and National Insurance.

NIC rates change depending on income. At higher levels, the rate drops to 2% on the top slice. The right saving rate shifts with profits, so check your own situation.

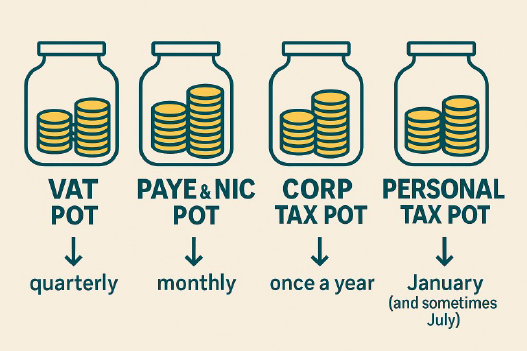

6. The pots – keep it simple

Here’s the easy version:

Everyone: Personal Tax pot

Companies: Corporation Tax pot

If paying salaries: PAYE/NIC pot

If VAT-registered: VAT pot

When do the pots empty?

PAYE & NIC → monthly

VAT → quarterly

Corporation Tax → once a year (9 months after year-end)

Personal Tax → January (and sometimes July)

Keep these pots topped up, and tax bills stop being scary — they’re just bills you’ve already prepared for.

7. Why this helps

Work in the arts often comes in bursts. Some months you’re busy, others are quiet. Saving into pots smooths things out.

And you don’t have to guess the right amounts. We can help you work out sensible percentages for your own situation, so you’re saving enough — but not more than you need.

That way, you can focus on your creative work, not on worrying about HMRC.

Contact Accounts Action

Want to make tax saving stress-free? Get in touch — we’ll help you set up a simple system that works for you.

Quick Guide:

Think in Pots — set money aside as you earn it, so the taxman never catches you out.

Which pots do you need?

Personal Tax Pot – for everyone.

Corporation Tax Pot – if you run a company.

PAYE & NIC Pot – if the company pays salaries.

VAT Pot – if you’re VAT registered.

When do the pots empty?

PAYE & NIC → monthly

VAT → quarterly (if registered)

Corporation Tax → once a year (9 months after year-end)

Personal Tax → January (and sometimes July too, if payments on account apply)

How much should you save?

Sole traders → around 30–35% of profits for tax & NI

Companies → around 15–20% of income (after VAT) for Corporation Tax, plus extra for dividends

VAT → move the VAT part of every invoice into its own pot (you’ll normally reclaim VAT on many expenses, so you may end up with a buffer)

✅ Keep topping up the right pots.

✅ Don’t dip into company money for personal tax.

✅ Tax bills stop being scary when you’ve already planned for them.