NHS Pension CrisisThe Facts

There has been plenty in press in recent times regarding the NHS Pension Crisis.

This crisis has been brought about by short-sighted tax changes introduced in 2016/17 to block a perceived loophole allowing wealthy individuals to avoid paying the, then new, an additional rate of tax (45%) by making excessive pension contributions. Un-intentionally many senior doctors who are members of the NHS scheme have been caught by this resulting in large and often unexpected tax bills.

These rules combined with the fact that Doctors have very little control over the number of pension contributions they pay have had the effect of creating an environment of diminishing returns for additional work. This has discouraged many doctors from taking on additional work and resulted in a serious senior staff shortage and increase waiting lists and an increase in time taken to get a GP appointment.

IA survey carried out by the Royal College of Paediatricians and Child Health, found that over half of the respondents had changed their working patterns or had ceased taking on any additional work or taking on senior positions in their trusts.

GP surgeries that have already been having difficulties in recruiting partners and senior-level practitioners are now finding it increasingly difficult to fill these senior positions.

What are the tax rules behind this crisis?

Excess Pension Input Tax Charge

On 6 April 2006, the government scrapped its rules on the amount that can be paid into pension schemes, and at the same time introduced new rules to limit the tax relief that could be obtained on excessive pension contributions. Initially, this was not too much of an issue for members of the NHS pension scheme however in 2011/12 the threshold at which this charge kicked in was slashed to £50,000 in a knee-jerk reaction following the introduction of the additional rate of income tax of 45%. The government believed wealthy individuals would pay excessive pension contributions in a bid not to pay this additional rate of income tax.

Even at this threshold, it was only the very highest paid clinicians with the highest superannuation contributions that were affected.

The threshold at which excess pension input tax charges became payable was further reduced in 2014/15 to £40,000, however, the crisis really took off in 2016/17 when further rules were introduced to taper this threshold down to as little as £10,000 if the clinician making the contributions had taxable income in excess of £110,000.

This was also not helped by the fact that NHS pension schemes are ‘defined benefit’. This means that the benefits on retirement are based on the member’s earnings whilst contributing, rather than the actual amounts contributed. In this situation, the tax rules compounded the crisis by prescribing that the ‘deemed contributions’ for members of the NHS schemes must be based on the growth in their pension benefits and not the actual amounts paid.

This is done by working out the contributions that the clinician would have had to have made to a money purchase pension scheme to achieve the same growth in benefits on retirement.

Given the nature of the NHS pension schemes, this can give rise to some unexpectedly high levels of deemed contribution often far in excess of the amounts of superannuation actually paid.

Lifetime Allowance

There is a further tax change that can result in a significant amount of tax being taken directly from a clinician’s pension fund, in addition to the annual Excess pension input tax charge.

There is a limit to the amount of pension pot that can be built up without creating a tax charge when the benefits are taken, the pension holder dies or reaches the age of 75 or the pension pot is transferred offshore. This limit is currently set at £1,055,000 (The lifetime allowance).

If the value of your pension fund exceeds this amount when one of these events occur a tax raid on the pension fund will be made by the taxman at 25% of the pension value above the current allowance if it is taken as income or, 55% if the amount is withdrawn as a lump sum.

To complicate this further there are different rules for valuing a pension fund for this charge than used for the annual charge

Fortunately, there have been several opportunities since 2006 when the Lifetime Allowance was first introduced, for pension holder to protect their lifetime allowance each time the standard allowance was reduced. This was available if the clinician’s fund exceeded that standard allowance at the time.

Currently, the 2016 protection is the only one that can be applied for to preserve your protection up to £!.25m.

The upshot of this is that if your pension fund exceeds £1,055,000 or your protected amount when you take your pension benefits or reach 75 a further amount of tax will be taken from your fund.

How this affects senior clinicians net income

These rules will affect every member of the NHS pension scheme to a different extent depending on their level of income, their year on year change in income, pension benefits already accrued and which section of the NHS pension scheme they are in.

However, as an illustration, I have prepared the following, simplified, examples:

Example 1

Dr A Locum has been a General Practitioner for 20 years and is now working as a locum. She has built a pension in the 2015 section of the NHS pension scheme of £25,000 p.a. at the start of the 2018/19 tax year. She has also chosen to pay superannuation contributions on all her locum income by completing Forms Locum A & B for each payment to her. Her income includes the employer’s superannuation uplift to her payments.

In this scenario, the diminishing returns for the work carried out By Dr A Locum start at an income level of approximately £130,000. This would be a High Level of Income for a Locum GP and therefore this is unlikely to be an issue for her if she takes on additional sessions or an additional role.

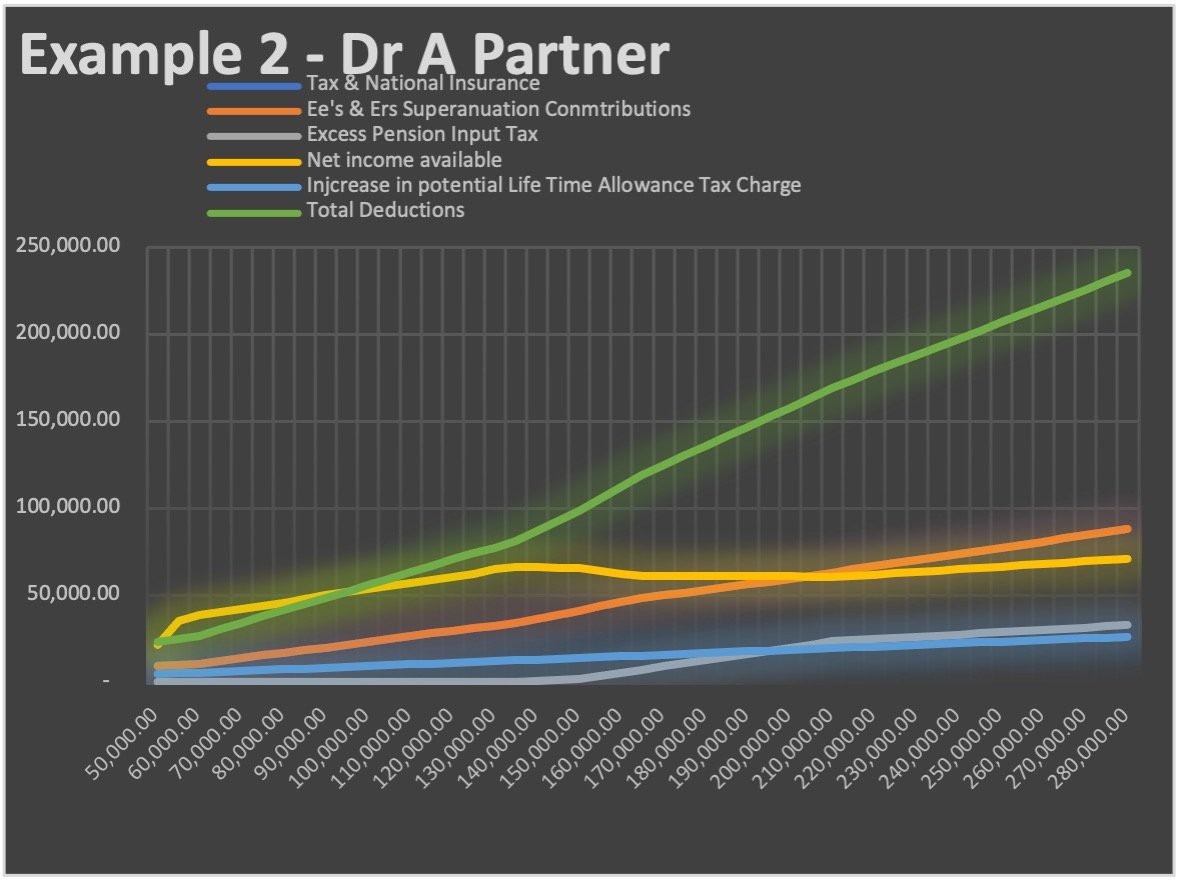

Example 2

Dr A Partner has been a GP in a successful practice for many years and has built up a pension of £56,250 in the 2008/2015 section of the NHS pension scheme and continues to contribute to the scheme

In this scenario the diminishing returns for extra work carried out starts at approximately £140,000 income., however as Dr Partner’s pension valuation is higher than the previous example (due to his previous hard work and pension saving) he will be in an unacceptable situation (if we factor in the future potential increase in lifetime allowance tax charge) where he will be worse off by working to increase his income.

Example 3

Dr Standing has been a partner in a large successful practice again for many years, due to the GP recruitment crisis and the ageing profile of GP’s his 3 partners have retired and Dr Standing has been unable to recruit any new partners leaving him as the ‘Last man standing in the practice.

Even though he is using locums and salaried GP’s to cover the secessions that were once worked by his partners his income levels have been high in recent years and his pension built up to the start of 2018/19 has reached £75,000:

In this final scenario, the point at which the diminishing returns starts remains similar to the previous example, however as Dr Standing is not sharing the practice profits with any other partners he is likely to have income levels further to the right of the bottom axis (income) leaving him in the zone

Other factors that can contribute.

There are many factors effecting the level of the disincentive to carry out additional work however the amount of income earned in a particular year and the amount of pension built up at the start of the year are the main drivers of this. Therefore, members of the scheme should be particularly wary if they have had a significant increase in income in a year such as a pay rise or if they received a clinical Excellence award. They should also take advice if they intend to purchase additional years or additional pension.

Scheme Pays Elections

To help with cash flow and delay the effect of the Annual Excess Pension Input Chare it is possible to make an election that will fund this tax charge directly from your NHS pension pot.

Up until 2018/19 thus had the effect of reducing the growth in the NHS pension meaning although the clinician avoided having to pay the tax out of his current earnings the effect is kicked down the lane and will be felt as a reduction in their pension benefits on retirement.

The good news is that to relieve the crisis the NHS announced in late 2019 that for 2019/20 they will accept these elections and make up any shortfall in the members pension on retirement.

We were also promised by Sajid Javid that he intended to look into this when planning his 11th March 2020 budget, however following his shock replacement with Rishi Sunak in February 2020 we await to see if a more permanent solution to this crisis will be included in the budget.